In Saudi Arabia, slowly but steadily, a fintech revolution is underway. The Arab Kingdom has locked its sight on an ambitious mission for a vibrant society and thriving economy, and digital SME business finance forms an integral part of it. The country has seen a 14.7x increase in fintech companies over 4 years, flying past its target of 60 fintech companies by 2030, to touch 147. In the past year itself, it saw 79% growth, with investments crossing USD 400 million.

The driving force behind this momentum has been the regulatory push for innovation outlined by the Kingdom’s Fintech Strategy. In the past few years, financial regulators have introduced several policies and licence initiatives for payment service providers, digital banks, debt crowdfunding platforms, open banking providers and more. They have also set up independent bodies and various programs to facilitate entrepreneurial creativity.

Entrepreneurs, or small and medium enterprises (SMEs), and their contribution to the economy, sit at the heart of the Kingdom’s mission. Saudi Arabia counts more than 978,445 SMEs, which account for 99.5% of all businesses. However, a mere 6%, or only one in twenty SMEs, use commercial banks in the country. This is one of the fundamental gaps that the Kingdom’s fintech strategy aims to correct.

Already, the nascent SME lending market is witnessing significant growth driven by fintech innovation. In 2021, Saudi Arabia observed 884% year-on-year growth in SME borrowing on Tamweel (Funding Gate), an automated lending platform launched by Monsha’at, Saudi’s SME ministry. SAMA’s regulatory sandbox also counts 9 debt crowdfunding platforms, many of which focus on lending to SMEs.

What should be considered in this development is the shift in roles that banks will undergo as the Kingdom’s financial services landscape evolves. With the introduction of Open Banking, banks will no longer have their data monopolies to rely on as barriers to entry for progressive competition. They will also need to consider the implications of newly licenced players entering the field. While banks face no lack of demand, the onus will be on them to provide services that are more contextual and relevant to the needs of the progressive economy and its population.

With this blog, we examine the evolving landscape of SME business finance in Saudi Arabia driven by the Vision 2030 framework, and highlight some of the key use cases that are emerging as a result. We specifically analyse the implications of these developments on banks and their options to proactively contribute to an SME-led progressive future for the Kingdom’s economy.

Saudi Arabia’s SME Vision for the Future

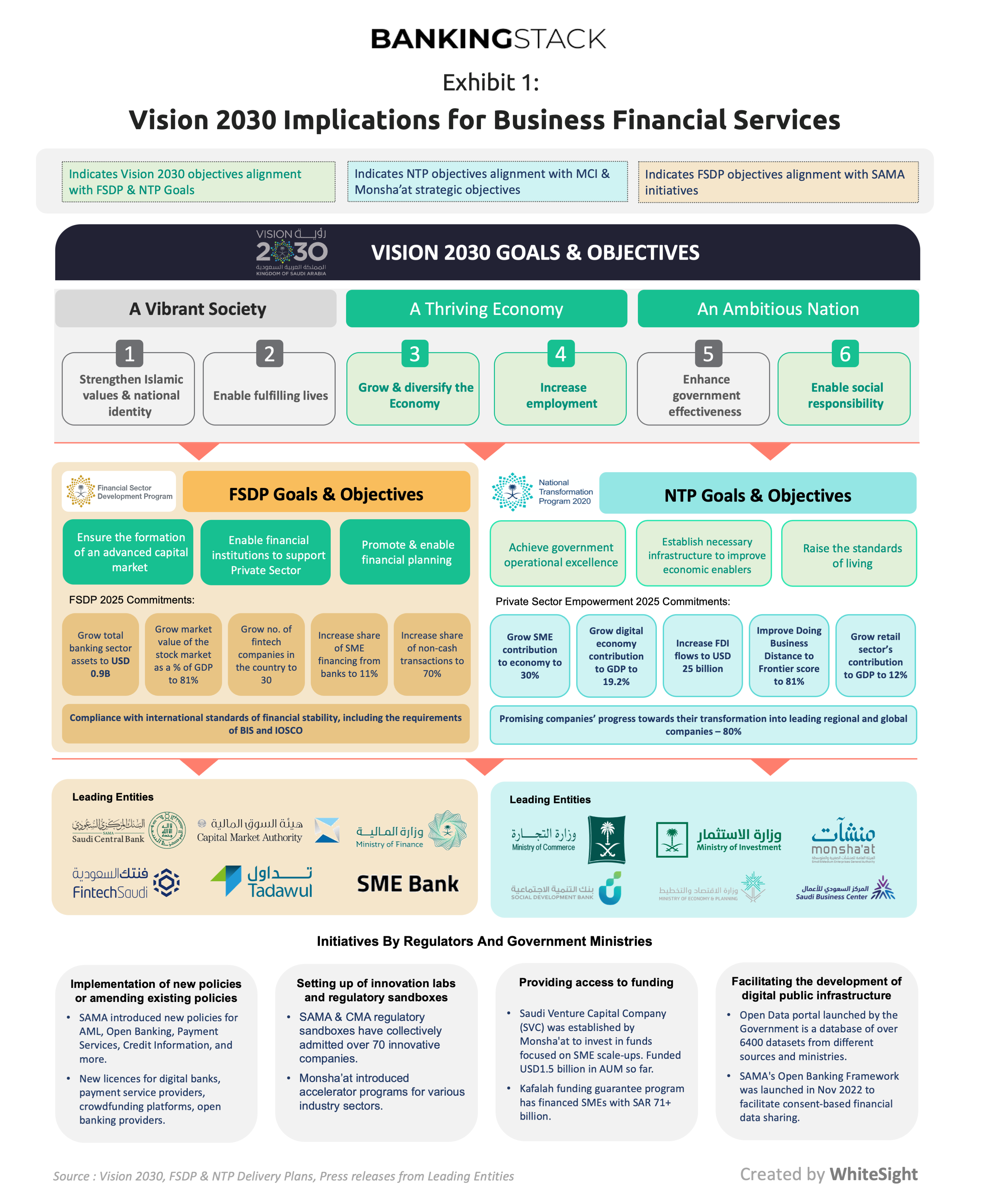

Saudi’s overarching transformation plan, Vision 2030, frames aspirations of economic progress through growth of SMEs and a better-developed financial services industry. The long-term program, which was introduced in 2016, consists of eleven Vision Realisation Programs (VRPs) that cover various dimensions of the plan. The National Transformation Program (NTP) and the Financial Services Development Plan (FSDP) are the two VRPs that address the development plan for financial services, private sector businesses, and business finance.

Exhibit 1 presents an overview of Vision 2030’s strategic development goals set as part of the NTP and FSDP programmes, and highlights the commitments mapped for the intermediate phase up to 2025. Focusing on SME-centric financial services, FSDP aims to increase the share of SME financing from banks to 20% by 2030 compared to 5.7% in 2019. Similarly, NTP aims to grow SME contribution to the GDP to 35% by 2030 compared to 22% in 2016.

The Role of Banks in the New Scheme of Things

As responsible agents of financial intermediation and capital allocation, banks have a key role in the transformation mission. With the Vision’s aim to diversify the Kingdom’s economic dependency on oil, banks need to actively diversify their books towards the retail and SME domains in non-oil categories. And this won’t be possible through reliance only on traditional financing propositions. There is a need for innovation in operating models and business models that banks need to consider to exploit the opportunity that is on offer. These innovations may include transformation at several levels, such as:

- Product transformation: From traditional asset-based business financing products to current and future cash-flow-based business financing products for SMEs.

- Process transformation: Evolving their underwriting, origination, and monitoring activities from being dependent on traditional and static datasets such as internal and bureau data, to leveraging real-time and dynamic datasets available through open banking data-sharing arrangements that allow banks to get a peak into SMEs’ business growth patterns.

- Distribution transformation: From controlling all the distribution channels for financing products, banks may look to building networks with non-financial digital platforms such as accounting, logistics, and marketing applications to embed their financial products at the point of need.

- Business model transformation: Finally, banks may look to grow their proposition beyond banking by delivering a holistic business finance solution for SMEs. Covering account aggregation, bookkeeping, automated reconciliation, invoicing, payments, expense management, payroll, etc., with seamless connections to banking flows, such a holistic offering allows banks to orchestrate end-to-end SME engagement across all their financial needs.

The Changing Landscape of SME Business Finance

Open banking is poised to be a game changer for the Kingdom’s fintech startups and incumbent banks. The framework was introduced in November 2022 and is scheduled to go live in Q1 2023 with Account Information Service (AIS) as the first phase, followed by Payment Initiation Service (PIS). Technology providers like Lean and Tarabut Gateway, which have been licenced by SAMA as open banking API providers, are already working with large banks like Riyad Bank, Saudi British Bank, Banque Saudi Fransi, Alinma Bank and more to facilitate next-gen financial services for their clients.

While in its initial stages, open banking might seem like an all-give, no-take model for banks, the real potential manifests once majority of the ecosystem has been connected, and participants can then reap the mutual benefits of consent-based open data flows. This is being observed in Europe and Asia Pacific, where open banking has matured over the past several years. Banks are evolving from being just sources of data, and are:

- Utilising data from non-bank networks to build personalised products for their customers. For example, Santander Consumer Bank launched Prosper in the Nordics as a personal finance management app for consumers.

- Enhancing tech capabilities to offer premium APIs and sandbox services to third-party providers (TPPs) to build and test innovative products allows banks to monetise their compliance spend as well as build an ecosystem of innovators on their platform. For example, DBS Developers launched by DBS Bank in Singapore offers a wide array of APIs for TPPs to plug into.

As the open banking ecosystem matures in KSA and progresses towards open finance and open data, banks in the region have an unprecedented opportunity to get real-time access to the digital footprints of both consumers and businesses. Specifically for SME finance, these data sources will include transaction accounts, procurement platforms, treasury, payroll, accounting, invoicing, tax, logistics, marketing platforms, etc. And this means banks can improve lead generation, origination, underwriting, monitoring, and collection processes for business finance products. This will allow banks to go after niche segments such as freelancers, sole proprietors, and micro-enterprises that were not cost-effective to serve earlier.

SME business finance has been a focal point for initiatives from incumbent institutions looking to meaningfully contribute to the FSDP goals. Bank–fintech partnership has been a prominent theme, with examples of:

- Cashin’s partnership with Saudi National Bank to offer an integrated financial platform for SMEs,

- Almina Bank’s partnership with cloud-based restaurant management solution provider Foodics, and

- SME financier Morabaha Marina’s expansion into digital payments by acquiring majority ownership in pay-tech Loop.

These examples highlight ways banks can collaborate with fintech startups to enhance their offerings while gaining access to previously unserved or underserved market segments. Open banking will act as a catalyst to fuel more such collaborations that will introduce a new zest of business financial services.

SME Business Finance Use Cases Driven by Fintech Innovation

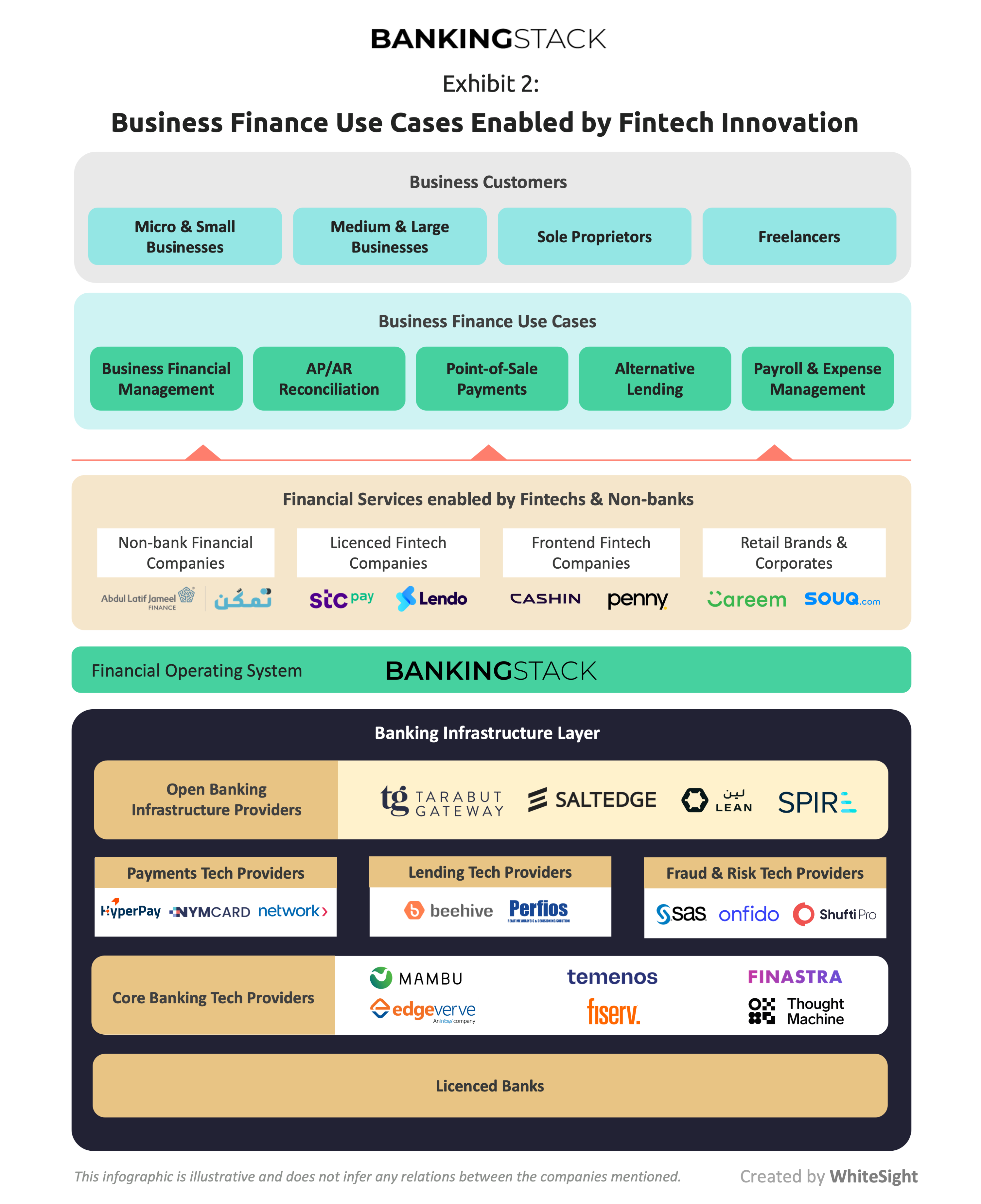

Business finance does not solely allude to “financing” in the literal sense but covers a wide range of core business financial services such as banking, payments, cash management, insurance, and administrative services such as accounting, bookkeeping, invoicing, expense management, payroll, and more.

Digitalisation has led to a step change in the way businesses operate. Over the past two decades owing to the fourth industrial revolution, business models have emerged that didn’t exist before. Therefore, banks have the opportunity to cater to not just the financing gaps, but also to the wider financial operating needs of businesses when approached in the right manner. We’ve previously spoken on this in The Need to Reboot Digital Banking for Small & Medium Businesses.

Innovation in business finance is the need of the hour for markets globally, and Saudi Arabia is no different. Financial services coupled with modern fintech infrastructure can drive an expansive set of business finance use cases for customers of all shapes and sizes, as depicted in Exhibit 2:

-

- Business financial management: Utilising account information services from connected entities, banks and fintechs can facilitate business users to access an all-in-one view of all their finances. This will enable better financial management for businesses in accounting, cash flow, accounts payable/receivable, and working capital. For example, Open Money, Asia’s first SME neobank, provides its users with the functionality to connect multiple bank accounts to manage receivables and track transactions.

- Accounts Payable/Receivable (AP/AR) Reconciliation: Invoicing integrated with payables and receivables can help businesses reduce time spent reconciling accounts to invoices. For retail businesses with a high volume of transactions, such a solution can be a game changer. In the UK, ANNA Money is a provider of business banking solutions that matches payments and invoices to simplify the AP/AR process.

- Point-of-sale Payments: In Saudi Arabia, the card payments market is expected to reach USD 219 billion by 2026. By enabling integrated point-of-sale connectivity with bank accounts, businesses can benefit from faster settlement times. This can also facilitate revenue or cash flow-linked financing options for small businesses, which can prove vital in growth. In addition, it opens up an avenue for banks to cross-sell retail financing such as buy now, pay later (BNPL) to the customers of businesses. For instance, Cashin’s partnership with Saudi National Bank allows the bank to offer integrated payment solutions to its SME customers and also connect to government platforms for compliance and taxation.

- Alternative Lending: Alternative financing options such as merchant cash advance, revenue-based finance, invoice factoring, unsecured working capital loans, and process-specific financing such as supply chain financing, etc., are different ways in which lenders can cater to the specific needs of various businesses. Driven by intelligent underwriting models and alternative data sources, financial institutions have a big opportunity to cater to the SME financing gap in the GCC region, which is estimated at USD 250 billion.

- Payroll & Employee Expense Management: For small businesses, payroll and employee expense management can become less painful when these solutions are integrated with their bank accounts. It can allow for faster reconciliation and settlement while providing better visibility over day-to-day finances. Some companies that are building such solutions are Payfit and Perkbox. The global market size of business spend management software is expected to be USD 39 billion by 2029.

Banks’ Opportunity to Lead the Change in SME Business Finance

The low contribution of SME loans in Saudi Arabia has been a function of a strong governmental presence in the economy—oil being the key contributor to the economy—and due to the lower availability of bank funding owing to higher risk and transaction costs associated with SME lending. We see both these factors being mitigated by government support to drive Vision 2030, as well as growth in the number of SMEs in Saudi Arabia, which as per Morgan Stanley, was up 34% in 2022. The goal to grow SMEs’ GDP contribution from 20% in 2016 to 35% in 2030 is coupled with an aspirational target of improving SME loan penetration from 6% in 2016 to 20% of total loans by 2030.

Banks in Saudi Arabia have an opportunity and obligation to deliver on the nation’s 2030 goals by leveraging everything that the government, regulators, and technology providers have to offer. The targets are steep, and the banking industry needs to respond in a decisive manner. This means leveraging state-of-the-art mid-office and front-office tech solutions to build a thriving ecosystem to bring the most relevant business finance product to SMEs when they need it and on the platform where they need it.

For banks, there are opportunities on two fronts:

- On the front end, banks can provide tech-enhanced business finance solutions to customers directly through their digital channels, or they could partner with ecosystem colleagues such as non-bank financial companies, fintech startups, and even digital platforms used by businesses to embed financial products at the point of need.

- On the back end, banks can work with data aggregation infrastructure providers that offer real-time consent-based data connectivity rails to multiple business platforms, such as bank accounts, accounting & taxation platforms, marketing and invoicing tools, e-commerce and logistics platforms and improve their origination, underwriting, and monitoring processes for business finance solutions.

To know how we can help, please book a demo or write to us at letstalk@bankingstack.com.