Digital banking for micro, small and medium enterprises (MSMEs) is poised for evolution in Southeast Asia. There are over 72 million MSMEs in the six key markets of Indonesia, Malaysia, Philippines, Singapore, Thailand and Vietnam, contributing significantly to the GDP, employment and exports. The segment is now being strengthened and transformed by rapid digital adoption. The internet economy in these markets is estimated at USD 173 billion gross merchandise value (GMV), with Indonesia ranking as the largest at USD 70 billion (2021).

But MSMEs still face critical difficulties in frictionless access to funding and modern digital banking services. Singapore is digitally the most developed region with the lowest credit gap of 5%, whereas Philippines has a very high one at 76%.

With evolving digital infrastructure and adoption in SEA, banks have an opportunity to bridge the gaps in servicing the MSME sector. The BANKINGSTACK X WhiteSight 2022 study into the MSME digital banking landscape across Indonesia, Malaysia, Philippines, Singapore, Thailand and Vietnam finds strong regulatory, infrastructure and technology tailwinds to support the digital evolution of banks. The report:

- analyses the MSME digital banking landscape in each country, along with the opportunity market size for five key business banking lines (cards & expense management, payments, digital banking, business financing and revenue-based financing)

- highlights readiness of each market for digital banking use cases that are currently dominated by fintech companies

- delivers an adoption framework that can help banks offer newer products and services, integrated with traditional banking, to help MSMEs meet their run-the-business and grow-the-business requirements.

Ultimately, the report concludes, the next decade will see banks evolve into a holistic ‘financial OS’ that leverages the MSME digital data footprint to meet their emerging digital banking needs.

MSME Digital Banking Opportunity in Southeast Asia

The key findings from the report point towards a turning point in MSME digital banking solutions in the region. 2021-22 has been a period of recovery and resurgence for the region, and the SEA internet economy is expected to grow at 20% CAGR to touch USD 360 billion GMV by 2025.

At the same time MSMEs have digitalised their trade, operations and back-offices creating deep data footprints that banks can use. This trend will only rise further, with 49% MSMEs in Indonesia and Thailand planning to increase adoption of operational software in the next 5 years.

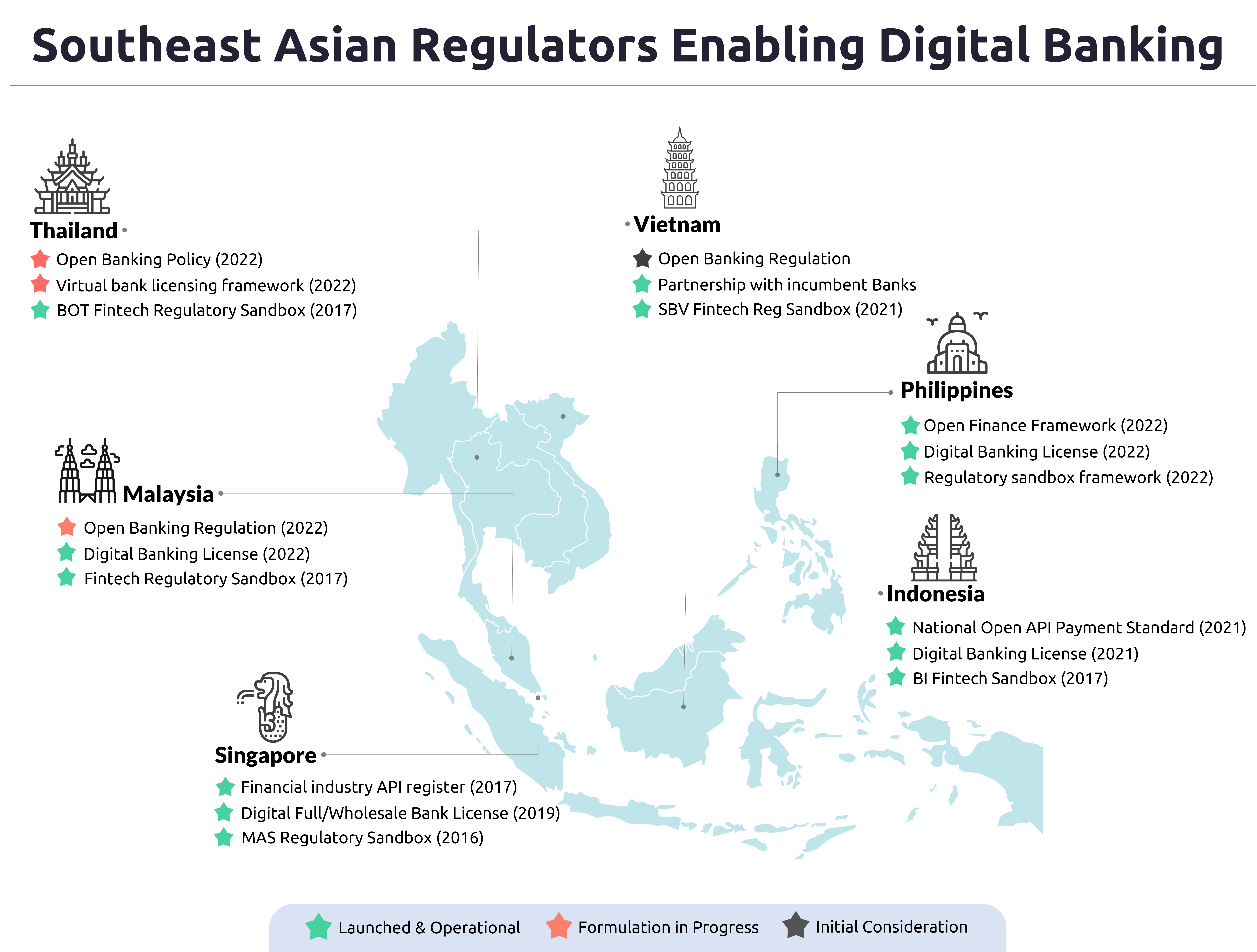

SEA regulators and governments have recognised the potential of fintechs in filling the digital banking gap as well as accelerate financial inclusion. MSME sector stands to benefit the most from these initiatives such as launch of digital banking licensing frameworks and open banking policies. All the six key countries have operational regulatory sandbox frameworks. (Exhibit 1)

Exhibit 1: SEA Regulators Enabling Digital Banking in the Region

Understanding the detailed outlook and opportunities in these six countries can help banks define their roadmap for key business banking areas. The report analyses varied market dynamics, maturity and digital readiness in each of the six markets to:

- Highlight outlook on Digital Customers, Digital Economy, Digital Finance and Digital Operations

- Highlight opportunity size and value pools for banks in Digital Payments & Open Banking Payments, Digital Banking & Digital Lending Services and Embedded Finance & Automation Services

MSME Digital Banking Use Cases & Challengers

Fintechs, unlike banks, have taken a focused, segment-specific approach to product innovation. Importantly, fintechs are bundling value-added services on top of traditional banking products to drive greater engagement across the business lifecycle.

Banks too are realising the need to take a holistic, needs-based approach to the MSME segment. The report presents a market readiness assessment, use case assessment and challenger case studies across five fintech-led digital banking products that have changed the MSME market.

Cards & Expense Management

Expense management processes are still manual for most MSMEs. Challenger fintech solutions are integrating cards & expense management, allowing MSMEs to issue virtual cards to employees for specific spends, receive real-time spend approval notifications, and save effort with automated reconciliation and integration with their accounting software.

Digital Payment Acceptance

Key SEA regions have high adoption of real-time payment rails and unified national QR systems. This lays down the innovation playground for new digital payment acceptance solutions, including contactless cards and mobile wallets.

MSME Digital Banking

Neobanks are re-defining the business banking account that integrate digital current accounts with bookkeeping, payments, collections, expense management, automated reconciliation and more.

B2B Buy Now Pay Later

B2B BNPL is gaining traction with the growth of B2B marketplaces and adoption of alternate payment methods in these marketplaces. This is a relatively new market segment for SEA which is expected to grow to USD 300 billion by 2024.

Revenue-based Financing

Revenue-based financing offers a huge opportunity to scale lending to MSMEs by moving to an alternate risk assessment model based on recurring revenue streams.

Adoption Framework for Banks to Reboot their MSME Digital Banking

The future of MSME digital banking lies in segment-specific product innovation and alternative risk models. Even as banks acknowledge this, the best approach to achieve this remains unclear as banks balance several multi-year, capex-intensive transformation projects with the need for agility in launching, testing and enhancing modern digital banking solutions.

The report offers banks an accelerated adoption framework that can reduce capex, business disruption and go-to-market time significantly.

Download the report here: https://www.bankingstack.com/reports/southeastasia-report